Abstract

Women rely more on intra- and inter-generational transfers for wealth accumulation than men (Bartels et al. 2023, Black et al. 2022), yet the role of inheritance in closing gender wealth gaps remains poorly understood. Using Swedish registry inheritance data from 2002-2004 combined with panel data on individual wealth portfolios and labour income from 1999-2007, we examine how wealth and income evolve for women and men before and after inheriting. Findings indicate that inheritance does not lead to long-term convergence in wealth between genders. Differences in portfolio composition may play a role, as women are less likely to hold assets that yield high capital growth. Daughters are also less likely to inherit businesses than sons, which compounds gendered differential access to productive assets. Heterogeneity analysis suggests that these differences are driven by structural barriers to financial resource accumulation over the lifecycle rather than from inherent gender differences in investment preferences. Additionally, women tend to reduce their labour supply more than men following the loss of a parent, reinforcing disparities in wealth accumulation. By disentangling the effect of losing a parent from receiving an inheritance, we attribute the larger effect to care responsibilities. Given these findings, inheritance alone should not be viewed as an effective mechanism for reducing gender wealth inequality, as it does not create lasting change in wealth gaps.

Download

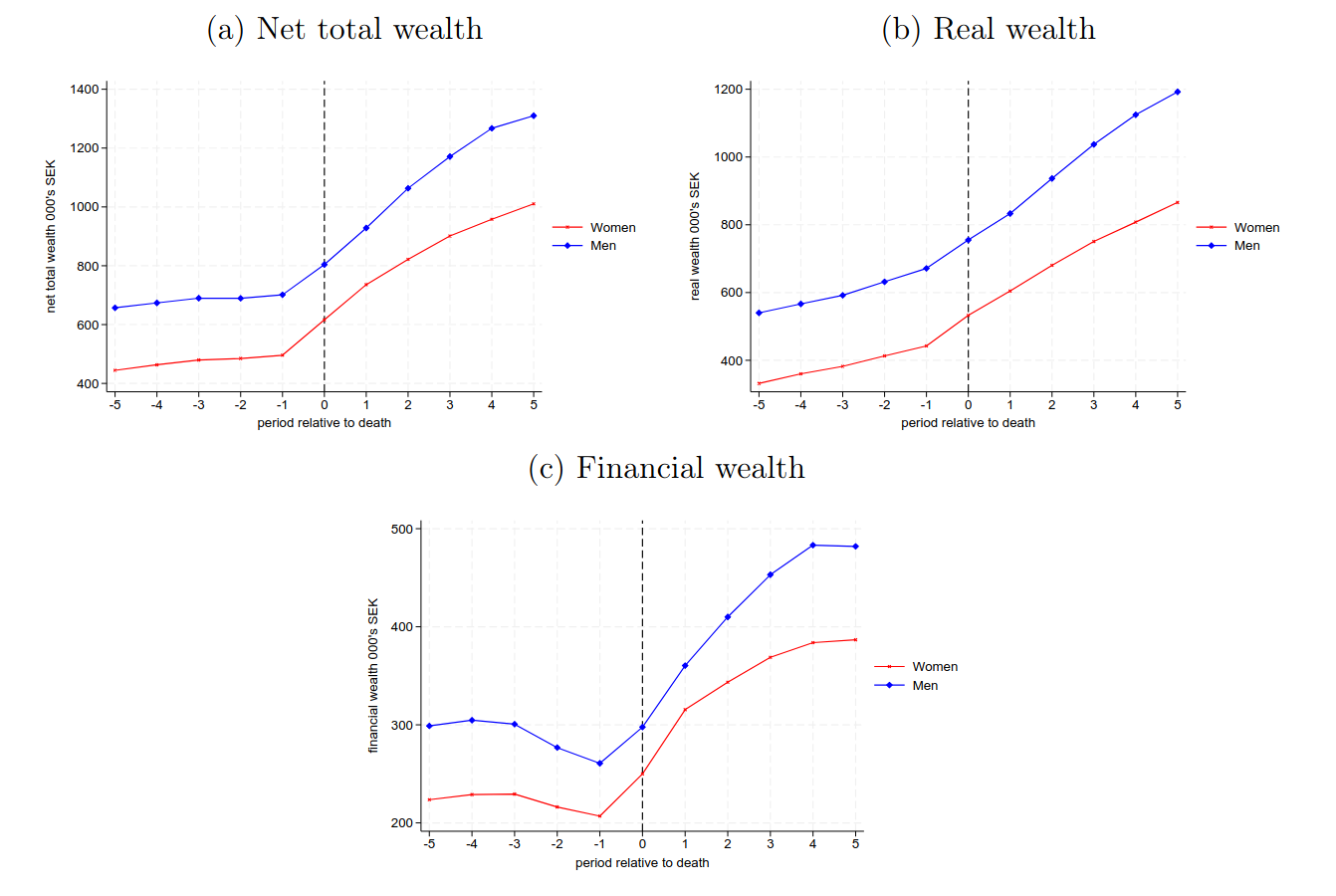

Wealth by gender pre and post inheritance - all heirs

Citation

Crowther, Naomi and Roos, Louisa. Shaping Women’s Fortunes: Inheritance and Gender Disparities (January 27, 2025).